At the same time, home prices have declined at an 8.5% rate, and a series of defaults from over-leveraged developers has triggered a collapse in commercial properties. This is significant since so much of Chinese wealth is tied up in real estate.

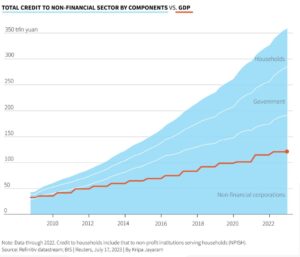

In the past, the Chinese government has propped up economic growth with stimulus spending on infrastructure, to the point where the country now has super-fast train systems with excess capacity and gleaming skyscrapers sitting empty. The Chinese central bank recently cut interest rates by 100 basis points, hoping that would trigger more borrowing and spending, but total debt of 350 trillion yuan—three times the country’s gross domestic product—makes you wonder how much more debt the nation’s citizens, companies and government would be willing to take on.

The recipe for escaping a recession or even a depression is relatively clear: clean up the property sector, restructure municipal and developer-related debt and switch to an economic model that doesn’t rely on ever-increasing amounts of debt-fueled stimulus spending. But nobody seems to expect the Chinese leadership to take drastic or even ambitious measures in those directions. Their goal, as one analyst put it, is to ‘maintain social stability,’ which can be translated to mean: staying in power regardless of the economic consequences.

Sources:

- https://www.reuters.com/world/china/chinas-consumer-prices-suffer-steepest-fall-since-2009-deflation-risks-stalk-2024-02-08/

- https://www.reuters.com/world/china/pressure-grows-china-big-policy-moves-fix-economy-2024-02-22/

- https://www.reuters.com/world/china/weak-data-limited-stimulus-keep-investors-away-china-2024-01-17/

Disclaimer:

Material discussed is meant for general informational purposes only and is not to be construed as tax, legal, or investment advice. Although the information has been gathered from sources believed to be reliable, please note that individual situations can vary. Therefore, the information should be relied upon only when coordinated with individual professional advice. This article was written by an independent third party. It is provided for informational and educational purposes only. The views and opinions expressed herein may not be those of Guardian Life Insurance Company of America (Guardian) or any of its subsidiaries or affiliates. Guardian does not verify and does not guarantee the accuracy or completeness of the information or opinions presented herein. Registered Representative and Financial Advisor of Park Avenue Securities LLC (PAS). OSJ: 5280 CARROLL CANYON ROAD, SUITE 300, SAN DIEGO CA, 92121, 619-6846400. Securities products and advisory services offered through PAS, member FINRA, SIPC. Financial Representative of The Guardian Life Insurance Company of America® (Guardian), New York, NY. PAS is a wholly owned subsidiary of Guardian. LIVING LEGACY FINANCIAL INSURANCE SERVICES LLC is not an affiliate or subsidiary of PAS or Guardian. Insurance products offered through WestPac Wealth Partners and Insurance Services, LLC, a DBA of WestPac Wealth Partners, LLC. CA Insurance License #0F64319, AR Insurance License #9233390 | 2024-170741 Exp. 03/26 | This material is intended for general use. By providing this content Park Avenue Securities LLC and your financial representative are not undertaking to provide investment advice or make a recommendation for a specific individual or situation, or to otherwise act in a fiduciary capacity. Guardian, its subsidiaries, agents and employees do not provide tax, legal, or accounting advice. Consult your tax, legal, or accounting professional regarding your situation.