The idea that the U.S. government has to manage its finances like a household is patently ridiculous. You and I and the family down the street don’t have the power to impose a tax on our fellow citizens and corporations when our bills come due.

Unlike the government, if we tried to print money, we’d get arrested. Unlike us, the government takes on a number of societal obligations that benefit various citizen constituencies, including protecting us from outside military threats, maintaining our legal system, running our national parks, paying the salaries of our Congressional representatives and people like air traffic controllers, food safety inspectors, Treasury workers and 75,000 other federal employees, not to mention cutting the checks for retirement benefits like Social Security and Medicare.

When you and I take on debt, it doesn’t show up in the marketplace as Treasury bonds; that is, when we incur debt, we don’t create what have long been regarded as the most stable investment option for peoples’ investment portfolios. You and I don’t have the power to issue our own currency, much less have it be the currency that global trade relies on.

But there is one area where managing the government’s finances and managing a household’s finances are pretty much identical: we both need to pay our bills on time. If you and I were to refuse, no matter how tempting that may be when the invoices arrive, there are consequences, pretty much all of them bad. For us consumers, not paying our bills will result in an accumulation of interest payments on the credit cards, a reduction in our credit score, and possibly foreclosure on our home, car and other assets that we’ve accumulated over the years.

For the government, the consequences are broader. Among other things, the government won’t stop paying interest on the bonds in investment portfolios, and there is potentially a huge loss of confidence in the world community about the willingness of the richest country in the world to meet its financial obligations like an adult.

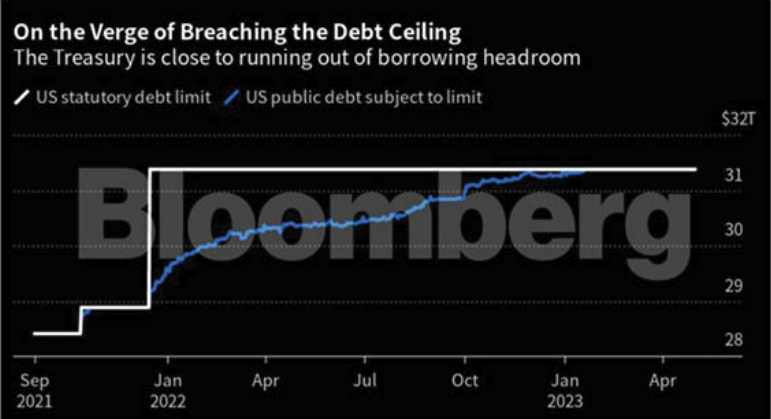

This is, of course, a discussion about the current debt ceiling debate in Congress, and about the fact that, unless the U.S. House of Representatives votes to raise the debt ceiling, the government will run out of cash to pay its various bills on or about June 7.

Unfortunately, the issue has become political; House Republicans are demanding that the government impose some spending cuts (not always clearly articulated) before they’re willing to give their permission for the government to issue more bonds, while the Democrats are arguing that the Republicans are holding the country hostage.

If you want to run with the household analogy, the debate can be seen as a family recklessly running up a lot of debt, and then refusing to pay its bills until all the family members have agreed to set a proper budget in the future. And predictably, the family members can’t agree.

There is no question that the U.S. owes a lot more money to its various creditors and bond investors than it ever has before, and there is obviously a huge difference in spending philosophy between the two political parties. The problem for the rest of us is that a government default would impose a lot of collateral damage: the value of Treasury bonds would almost certainly plummet, because many bondholders would be uncertain about how and when they would get paid. There would be a nervous tremor rippling through the stock market, which would cause a temporary decline in the share prices of the stocks we own. Interest rates would skyrocket, because lenders and investors would demand higher returns for the added risk of not getting paid. Stable assets would look suddenly less stable. And there’s no telling what would happen to the value of the dollar.

The Council of Economic Advisors has calculated that a protracted default would result in the loss of 8.3 million jobs in the U.S. economy, and reduce GDP by 6.1%—a recession the size of the Great Recession that most of us still regard as a painful memory.

The debt ceiling may become a moot point in a month or so; most investors seem to be expecting that, before June 7, the House of Representatives will decide that it’s more important to pay America’s bills than to score political points. But it should be noted that the cost to insure U.S. bonds from default—known as the credit-default swaps—is now higher than the cost of similar instruments insuring the government bonds of Greece, Mexico, and Brazil. This is another way of saying not everybody is confident that this game of chicken will end peacefully.

Never before has the government passed that X-date without finally raising or suspending the statutory limit on federal debt. But if that deadline were to pass without action, and the U.S. finds itself in a global crisis entirely of its own making, then all of us will need to buckle up for a lot of market and economic turbulence.

None of this takes away from the fact that there are some very real questions about how the U.S. budget should be organized going forward; the government ‘household’ probably does need to get its finances in better order. If you have a spare hour or two, you might consider making your own budget decisions, through an online portal that allows all of us to input our priorities and see how that impacts the deficit going forward. Go here: https://www.crfb.org/debtfixer, and create your own government ‘household’ budget. You might find that it’s harder than you realize, throw up your hands and tell the government that it’s okay after all to start printing more bonds.