By

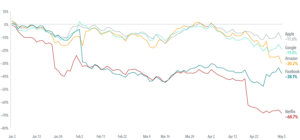

Investors expecting FAANG1 stocks to continue the extraordinary performance of recent years must be disappointed by their returns in 2022 (see Exhibit 1). Four of the five stocks lagged the broad US market through May 5, with Amazon, Facebook (now known as Meta), and Netflix suffering big-time losses. The group collectively underperformed the Russell 3000 Index2 by nine percentage points.3

EXHIBIT 1

Bite Wounds

Cumulative returns of FAANG stocks, January 1, 2022–May 5, 2022

Past performance is not a guarantee of future results.

This year’s swoon came on the heels of a stellar decade—the FAANGs returned 28.02% per year from 2012 to 2021. Their returns dwarfed the performance of the Russell 3000 Index, which returned 16.3% per year.

This year’s reversal is a reminder that investors should be cautious when assuming past returns will continue in the future. FAANG stock performance in recent years reflected these companies achieving financial success that exceeded most investors’ expectations. That’s in the past, though. Even if these companies sustain their success (and things have been looking gloomy for Netflix!), it may not translate to spectacular future returns. Excellence from the FAANGs may now be the expectation and not the basis for above-market returns.

Download a PDF here: https://www.dimensional.com/us-en/insights/have-the-tech-giants-been-defaanged