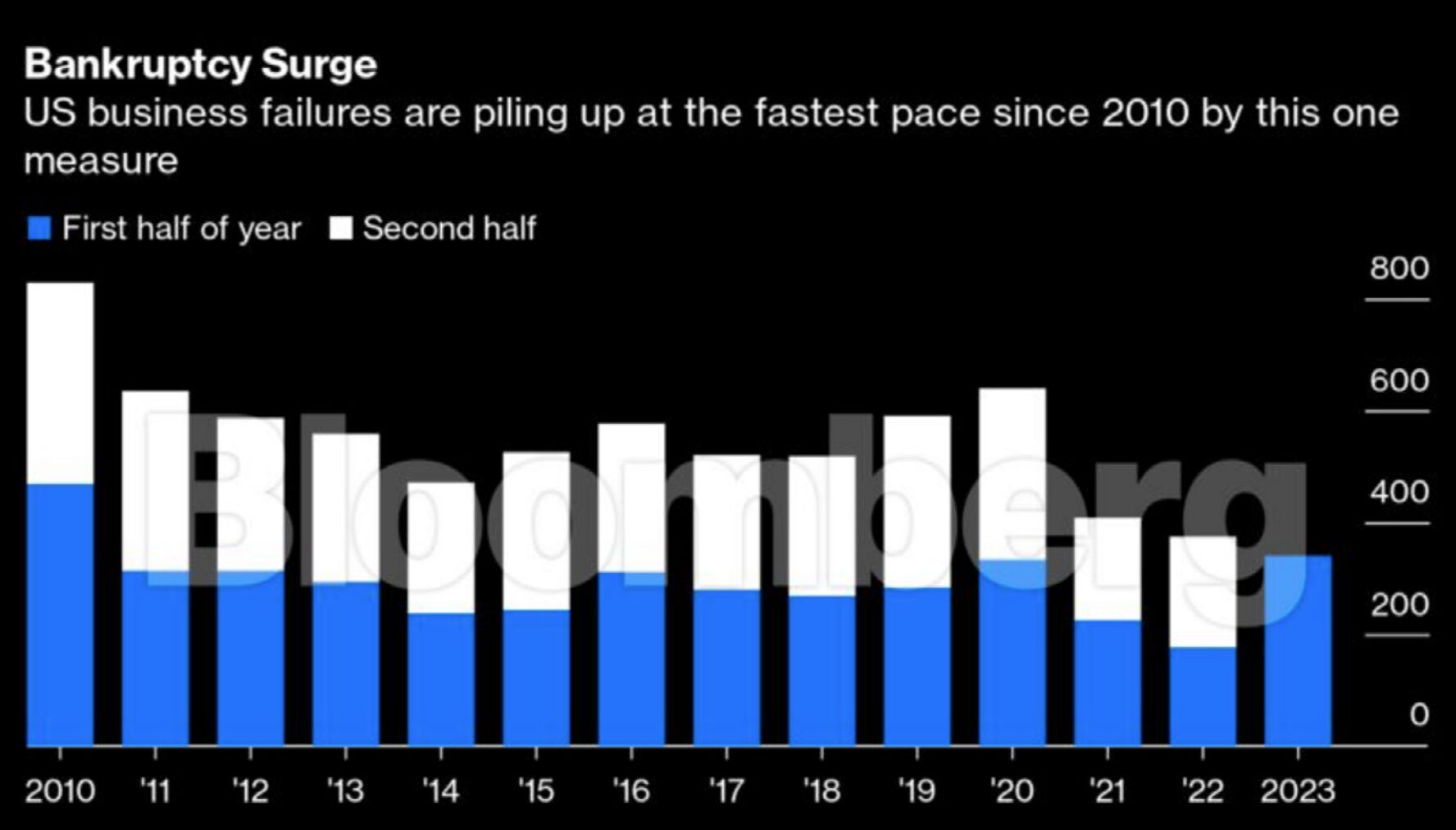

If you’re looking for something to worry about, consider bankruptcies. Normally, we see an uptick in companies filing for bankruptcy during recessions—for obvious reasons. An economic slowdown generally means fewer buyers spending less money, and companies that over-expanded, took on too much debt, or were poorly managed from a fiscal standpoint may be too weak to withstand the unexpected shock to their revenues and earnings. But right now we aren’t in a recession, and yet bankruptcies around the world are soaring. S&P Global Market Intelligence reports that in the first six months of this year, U.S. companies filed for bankruptcy protection at a rate not seen since 2010. In England and Wales, corporate insolvencies are near a 14-year high, Germany has seen its bankruptcy rate jump almost 50% over last year to the highest level since 2016, and Japan is experiencing a bankruptcy rate that is the highest in five years.

What’s going on? Even though labor markets and corporate profits overall are still at relatively high levels, there are other factors that are testing the resiliency of companies that got too far over their skis. Some firms over-leveraged themselves and were hit by the surge in interest rates. The aftershocks of high inflation were felt by companies that didn’t have a lot of pricing power, and were selling products at prices that became gradually unprofitable in order to protect market share.

So far, the bankruptcy wave hasn’t hit too many large corporations—the biggest example is US housewares giant Bed Bath & Beyond. But if the trend continues—and it might if we finally experience an economic recession—then the insolvencies could trigger a non-virtuous cycle of suppliers not getting paid, workers losing their jobs, banks further tightening their lending criteria—and more companies going bust. A number of boardroom executives are quietly crossing their fingers in hopes that interest rates will fall to more manageable levels; otherwise, a prolonged period of corporate distress could be in our future.