The normal retirement planning models say that when we retire, we will spend the same amount of money out of our retirement portfolios each year on living expenses, travel, eating out, etc., with that total amount only rising each year as inflation makes all of those things incrementally more expensive.

But is that actually true in the real world? A recent report by the RAND Corporation examined the spending patterns of older Americans who participated in the University of Michigan’s Health and Retirement Survey. RAND researchers found that for single retirees, real spending declined after age 65 at a rate of about 1.7% a year; for coupled retirement households, the decline was 2.4% a year.

There are several possible explanations for this. One is that people might find their living expenses less affordable as they get older. But the researchers concluded that this was not a factor, because they found that the wealthiest group of survey participants showed the same spending declines as those with less wealth. In fact, they found that as retirees got older, across all wealth categories, they spent an increasing share of their budget on gifts and donations.

A better explanation, proposed but not proven in the research, is that younger retirees are more vigorous and more inclined to take trips and eat out in their 60s and early 70s than they are when they get older. They might also become less interested in luxury goods like new cars and clothing as they age.

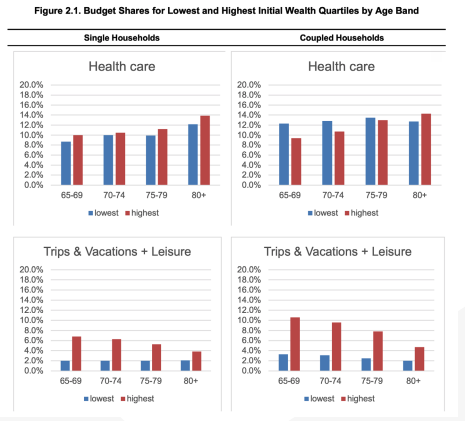

The median retiree household age 65-69 spent $28,505 (single) or $53,990 (married) a year, while retirees in their 80s spent $26,094 and $38,885 respectively. But of course there was considerable variation in this number; some retirees expect to spend more for a more lavish lifestyle than others. The study broke down expenditures by category, and found that trips and leisure expenditures fell the farthest as people got older (see chart), while healthcare expenditures were surprisingly stable, especially for coupled households. In all age categories, housing was the biggest budget item (23-25% of the total budget) followed by food (16-19%) and utilities (12-17%).

This healthcare statistic might surprise some people who had assumed that, later in life, people will have to allocate dramatically more to medical expenses than they did when they were younger and more vigorous. The study referenced an earlier study, which found that, for most individuals, the last year of life will typically engender a relatively affordable $6,800 in out of pocket payment for doctor and hospital visits; indeed, the healthcare percentage of a household’s budget averaged just 14% for people over 80 (compared with 9.4% for the youngest retirees). A relatively small number of people, roughly 10% of the sample, accounts for 42% of the out-of-pocket health-care spending in the later years of life—and the presumption is that much of this can be addressed by buying a long-term care insurance policy.