Oil’s Return to Normality

Just a couple of months ago, oil was selling on the international markets at upwards of $115 a barrel, and the gas prices at the pump were ranging around 4-5 dollars a gallon. Now, you can fill your tank at less than $3 a gallon in most places, and barrels of oil are trading at around $76. If you look at the 5-year price chart for oil, you can see the Covid pandemic and the Russian invasion of Ukraine having rather dramatic (and opposite) effects on oil prices, and the trend since mid-2022 has been a return to normalcy. Over the years, there have been a number of alarmist predictions about how the world is running out of oil, how temporary price increases were going to continue forever, etc. Each time the global economy corrected itself and reduced the alarming trend to a blip on the screen. If there is a trend, it is that demand for oil will continue to decline as alternative energy sources become more popular, and as more automobiles are powered by electricity. According to the most basic economic theory, lower demand would mean lower prices. In fact, total oil production worldwide last year (89.88 million barrels a day) is actually lower than production levels in 2015. The peak came in 2019 (just under 95 million barrels) and has been incrementally declining ever since. We aren’t running out of oil, but we are very slowly reducing our need or demand for it.

Trends and Forecasts

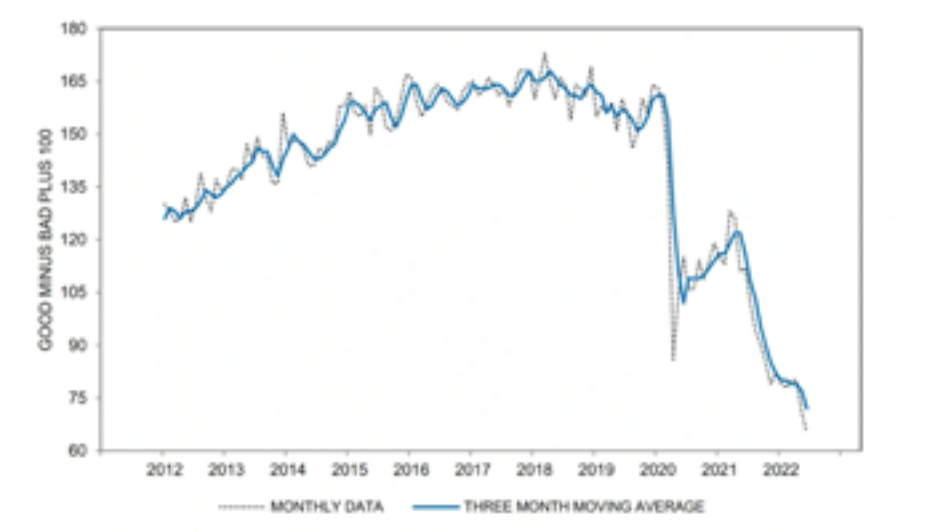

Every year, the Exploding Topics website issues a report on what its various surveys of economists say are the key economic trends for the next couple of years. In the latest report, it warns about the risk of stagflation (where inflation is high at the same time that the economy moves into a recession), but didn’t actually predict that this would happen. Real estate sales may drop, due to persistently high prices and high mortgage rates. Europe could experience an energy crisis this winter, and accelerating climate change may start becoming not just visible but damaging to global economies. The two trends that are likely to have an immediate impact on the economy and the investment markets have to do with consumer spending and the ability of companies to sell their goods and services. One of the charts, reproduced here, tracks the buying conditions for durable goods from the University of Michigan’s monthly Survey of Consumers. It found a rapidly plummeting situation, where high interest rates and rising prices are causing fewer consumers to finance expensive purchases.

If there is indeed a slowdown among consumers, that would cause manufacturers and retail outlets to experience a glut of inventory. Many of these companies expected that consumer demand would roar back after the pandemic ended, but those high prices and the fact that the pandemic lingered might produce a disappointing market experience that could lead to a short-term decline in sales and profits. One should remember that these are predictions, and predictions are not the same thing as reality. There’s a wonderful joke to the effect that the ‘science’ of economics exists in order to make the predictions of gypsy fortunetellers look reputable. To know what’s going to happen, we’re going to have to experience it directly.

Worst-Case Investing

The market is experiencing another lurching downturn after experiencing another couple of weeks of encouraging gains, and that tells you most of what you need to know about the markets. Despite the breathless reporting in the financial press, stock prices go up, and down, and up, and down more or less at random (in the short term) and consistently show incremental gains (in the longer term). Unfortunately, it’s hard to see that generally upward trend for all the short-term noise.

Of course, it’s possible that this time it’s different; that the century-long increases in share prices (plus dividend payments) are about to come to an end. We may be entering a time when all the efforts of all the people who go to work in the offices of all the publicly-traded companies (or, lately, in their homes) will lead, against all logic, to consistently declining long-term value, and the markets will go down, down, down until they finally touch bottom. Of course, long before that happens, most people will be out of work, companies in every sector will go bankrupt, and chaos will reign.

People will sometimes fear the worst, and ask what kind of investments would thrive in a worst-case economic/market scenario. And there is a ready answer for that. Your best ‘investments’ (if you could call them that) for a total breakdown of the economic system would be a hideout deep in the woods, guns and ammo to protect yourself from the hungry masses, and plenty of seeds so you could grow your own food. A very large stockpile of canned/concentrated food and access to a water supply would complete the picture, and if you believe that some kind of barter system would survive the global catastrophe, then maybe you could stockpile gold Kruegerrands.

Of course, the end of the world has been predicted more than a few times over the years, and their historical failure rate is running right at 100%. We may see a recession next year, we will certainly see more confusing fluctuation in share prices day in, day out, and the financial press will continue to think that these entirely normal market fluctuations are ‘news.’ But if history is any indication, patience in the markets, and a strong stomach for bumps in the roller coaster, may be rewarded in the end.

And if they’re not, we may have a lot more to worry about than the value of our investment portfolios.

Past performance is not a guarantee of future results. All investments contain risk and may lose value.