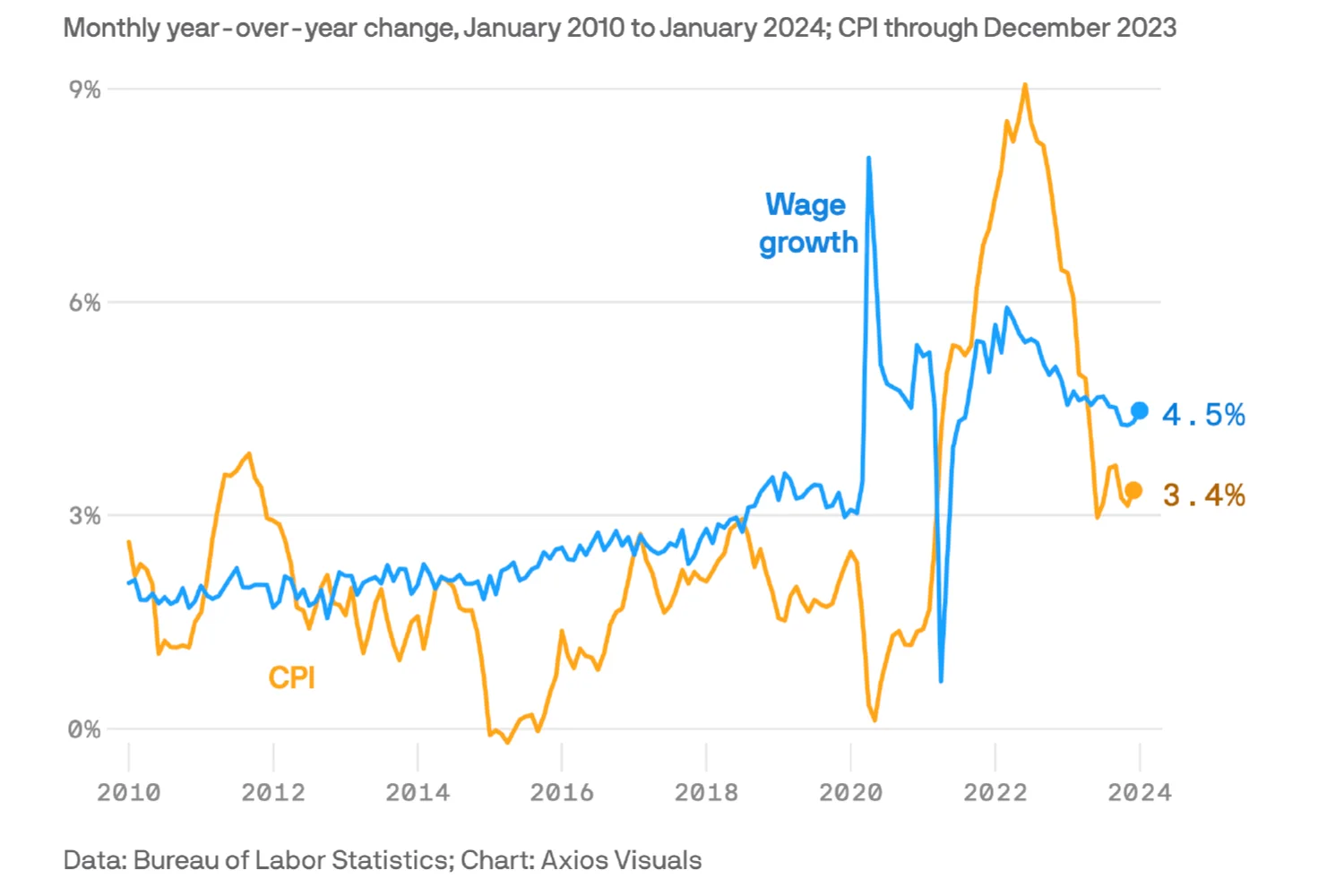

You might think that hourly wages and worker compensation closely tracks the inflation rate, but as you can see from the graphic, the two are in a constant tug-of-war; wages sometimes rise faster than inflation, and often they lag. Over the last year, wages have been winning this particular race; hourly wages are up 4.5% from this time last year, while the inflation rate, again over the past year, has come in at 3.4%. In March, the last month where we have statistics, the difference was 4.7% annualized (wages) vs. 3.5% annualized (inflation).

However, this is catchup; between 2021 and mid-2023, inflation was dramatically higher than the growth of worker income. Some economists believe that wages still have some catching up to do before they moderate to something closer to the inflation rate.

The statistics are also somewhat hard to read, since different states have different minimum wage levels. A worker earning the minimum wage in California takes home $15.50 an hour, while in Oklahoma, the wage might be as low as $2 an hour. And perhaps a more accurate gauge of how much workers should be paid is productivity; if the minimum hourly wage in the U.S. had kept up with productivity, it would be $22.88 an hour today, leaving inflation in the dust.

Sources:

Disclaimer:

The information contained in this article is general in nature and is not legal, tax or financial advice. For information regarding your particular situation, contact an attorney or a tax or financial professional. The information in this newsletter is provided with the understanding that it does not render legal, accounting, tax or financial advice. In specific cases, clients should consult their legal, accounting, tax or financial professional. This article is not intended to give advice or to represent our firm as being qualified to give advice in all areas of professional services. Exit Planning is a discipline that typically requires the collaboration of multiple professional advisors. To the extent that our firm does not have the expertise required on a particular matter, we will always work closely with you to help you gain access to the resources and professional advice that you need.

This is an opt-in newsletter published by Business Enterprise Institute, Inc., and presented to you by our firm. We appreciate your interest.

Any examples provided are hypothetical and for illustrative purposes only. Examples include fictitious names and do not represent any particular person or entity.

Registered Representative and Financial Advisor of Park Avenue Securities LLC (PAS). OSJ: 5280 CARROLL CANYON ROAD, SUITE 300, SAN DIEGO CA, 92121, 619-6846400. Securities products and advisory services offered through PAS, member FINRA, SIPC. Financial Representative of The Guardian Life Insurance Company of America® (Guardian), New York, NY. PAS is a wholly owned subsidiary of Guardian. LIVING LEGACY FINANCIAL INSURANCE SERVICES LLC is not an affiliate or subsidiary of PAS or Guardian. Insurance products offered through WestPac Wealth Partners and Insurance Services, LLC, a DBA of WestPac Wealth Partners, LLC. CA Insurance License Number - 0F64319, AR Insurance License Number - 9233390. | Guardian, its subsidiaries, agents, and employees do not provide tax, legal, or accounting advice. Consult your tax, legal, or accounting professional regarding your individual situation. | 2024-174417 Exp. 05/26