Taking Fate into Your Own Hands

Business owners are used to having control. But some things are uncontrollable, and without a plan, those uncontrollable things can create negative consequences that reverberate.

Consider the story of a fictional but representative business owner who learned why planning before he thought he was ready was so important.

A Stroke of Luck

Jerry Glasner’s employees fidgeted uncomfortably. His words about the company’s award-winning performance, which he had been delivering with his trademark booming confidence, began to slip from his mouth like an undercooked egg. Jerry saw the befuddled looks and looked out, confused. The last thing he remembered was his wife cradling his head and his daughter pleading for a doctor as he lay on the floor of the banquet hall that his company had rented for such a joyous announcement of his company’s success.

He awoke in the hospital. He had suffered a stroke. His prognosis was good, but his doctors said he would require speech therapy.

Jerry’s health scare made him realize how many people both relied on and cared about him. Though he would have never wished for such a terrifying experience to learn a lesson again, he did consider himself lucky. He was not only alive but also motivated to protect the family and employees he’d supported for the last 30 years.

With help from his Advisor Team, he created a set of contingency plans. These plans gave his family financial guidance and access to the wealth he had built outside his business if he were to die suddenly.

They set a line of successors that would allow his business to continue to operate in his absence while providing for his family and employees.

And they set aside a portion of company profits to install wellness programs for his company’s employees to help prevent similar scares in the future.

Starting Before You’re Ready

To pursue these plans, Jerry needed to adjust how his business operated. He discovered that while he loved being the engine that drove the business, he wasn’t comfortable with the idea that an unexpected health problem could easily cause the wheels to fall off of everything he had built.

Many business owners find themselves in a similar situation as Jerry.

You do so much and work so hard. But when all success radiates from one source, it can mean that removing that source removes any chance of success.

Fortunately, there are ways to plan for the unexpected. Between business continuity planning, estate planning, and planning for a successful future, business owners have options.

However, the best time to begin such planning is before you think you’re ready.

For example, while it was good that Jerry took steps to plan following his stroke, he missed out on a chance to take fuller advantage of life insurance policies due to his now-evident health issues.

The good news is that as long as you’re running your business, it’s never too late to plan for a successful future.

We strive to help business owners identify and prioritize their objectives with respect to their businesses, their employees, and their families. If you have questions on this topic, we can help with more information or a referral to another experienced professional. Please feel free to contact us at your convenience.

Monthly Market Commentary

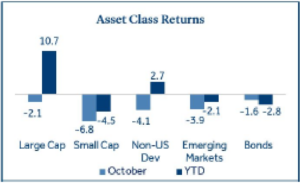

Asset class returns declined broadly for the third consecutive month in October. Treasury yields continued to climb and put pressure on both equity and fixed income assets as the 10-year yield reached 5% for the first time since 2007. In addition, a tepid start to the corporate earnings season combined with geopolitical uncertainty exacerbated risk aversion for many investors during the month.

- Domestic large-cap stocks (S&P 500 Index) outperformed small-cap stocks (Russell 2000 Index) by a wide margin, returning -2.1% and -6.8% respectively, as mega-cap technology stocks

outperformed.

- Bonds declined for six consecutive months for the first time since the inception of the Aggregate Index in 1976. Bonds fell -1.6% for the month of October.

- Non-U.S. Developed (MSCI EAFE Index) and Emerging Markets equities (MSCI EM Index) underperformed U.S. large-cap stocks, falling -4.1% and -3.9%, respectively. Expectations for slower economic growth in Europe and the ailing property sector in China weighed on non-U.S. stocks.

Domestic and non-U.S. Developed equity returns remain positive year-to-date, but performance has declined meaningfully since the July highs.

U.S. Stocks

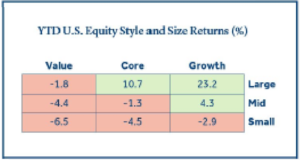

Growth-oriented, large-cap stocks have led the way year-to-date.

Several factors have driven outperformance for large-cap core and growth stocks relative to other domestic equity categories this year:

- Larger stocks overall can cushion the equity portion of a portfolio, relative to smaller stocks, during times of volatility and economic uncertainty like 2023.

- Large-cap indices contain little exposure to smaller regional banks which have struggled amid rising interest rates. They are also overweight technology stocks, which have been a top-performing sector year-to-date.

- Mega-cap technology stocks (e.g., Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla) have driven almost all year-to-date gains in the large-cap core and growth indices. However, the weight of these stocks is much higher in the large growth index (47%) vs. the large core index (28%) and has provided an additional boost to large-cap growth returns.

Large-cap outperformance has led to a widening valuation gap as the price-to-earnings (P/E) ratio for the S&P 500 Index (22) is well above the Russell 2000 Index (12). It could be an appropriate time for valuation-conscious investors to reassess their allocation to small-cap stocks.

Interest Rates

The 10-year U.S. Treasury yield increased for the sixth consecutive month. The 10-year Treasury yield added over 100 basis points since mid-July and has been assigned much of the blame for the pullback in equities, as borrowing costs have risen for businesses and consumers. Rates have been rising consistently since the Federal Reserve (the Fed) began their rate hike campaign in March 2022. However, a shift within the trend of rising rates is that longer-term rates have risen more than short-term rates. There are several potential drivers to the recent rise in longer-term Treasury yields:

- Fed rhetoric that interest rates will remain higher for longer amid elevated inflation.

- U.S. economic data has surprised to the upside as GDP, retail sales, and nonfarm payrolls all surpassed recent expectations.

- The risk premium to hold longer-dated Treasuries may be rising as global economic uncertainty and geopolitical tensions mount.

Historically, inverted yield curves have preceded recessions, but the curve tends to de-invert before a recession actually begins. The chart below depicts the Treasury curve de-inverting over recent months as yield spreads between short and long-term rates have narrowed, this development has put many investors on recession watch.

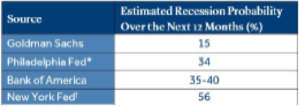

Recession Watch

U.S. economic data has provided mixed signals.

Although GDP, retail sales, and nonfarm payrolls all exceeded their most recent estimates, several potential economic headwinds remain:

- The Consumer Price Index (3.7%) is hovering above the Fed’s 2% inflation target and has risen or been flat for three consecutive months. Oil prices declined in October, but they have increased 8.1% year-to-date and could put pressure on headline inflation.

- The Leading Economic Index (LEI), designed to indicate the direction of the economy, has declined for 18 consecutive months with nine of the index’s ten components flat or negative in September.

Consumers may come under pressure as student loan payments resumed, pandemic savings have declined, and borrowing costs have risen.

*Philadelphia Fed Recession Probability Index. †Based on the nominal 10-year minus 3-month Treasury yield spread. Parameters are estimated using data from January 1959 to December 2009.

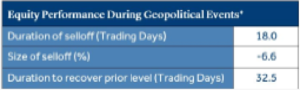

Geopolitical Risk

Conflict in the Middle East created additional uncertainty for investors.

First and foremost, our thoughts go out to those affected by recent events in Israel and the Middle East. It’s often difficult to predict the impact of geopolitical events on capital markets and the global economy. A few key points surrounding the current conflict:

- A primary market concern associated with conflict in the Middle East is rising oil prices, which have the potential to put upward pressure on inflation and dampen consumer spending. Although the price of oil initially increased 4.3% the trading day following the attacks in Israel, the price declined -8.7% for the month of October.

- The risk of escalation is top of mind for many investors. A broader conflict involving OPEC member countries (e.g., Saudi Arabia and Iran) could have economic ramifications.

- The initial effect on stocks was muted. The S&P 500 and MSCI EAFE (Non-US) Indices both registered positive returns in the first trading week following the beginning of the conflict.

Historically, geopolitical events lead to increased market volatility in the early stages, but it often subsides quickly. A 2022 Mercer paper “Peering through the Fog” analyzed 20 geopolitical events (e.g., Iraq war, Brexit vote, etc.) ranging from 1939 to 2017 which indicated the following:

*Data is based on the S&P 500 Index and represents the median for all 20 geopolitical events included in the study.

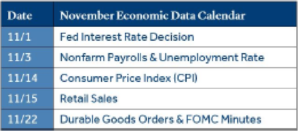

Economic Calendar

The Fed held short-term rates steady to begin November.

The decision to hold rates steady on November 1 was expected by many as Fed Funds futures suggested a 98% probability there would be no change in the short-term lending rate.

- The policymaking committee is likely near the top of the rate hike cycle as current Fed projections indicate the potential for one additional interest rate hike.

- Fed chair Jerome Powell stated, “the process of getting inflation sustainably down to 2% has a long way to go.” As of November 1, Fed Funds futures suggested the first rate cut is most likely to occur in June 2024.

- The Fed has continued to reduce its bond holdings (quantitative tightening) which has decreased the central bank balance sheet from $9 trillion to $7.9 trillion since March 2022.

Nonfarm payrolls will continue to be a focal point for investors as strength in the labor market has been a primary supporter of a soft-landing narrative for the U.S. economy.

Sources:

- Source: Morningstar Direct

- Source: London School of Economics

- Source: The Conference Board

- Source: Federal Reserve Bank of New York

- Source: Mercer LLC

- Source: CME FedWatch Tool

- Source: Federal Reserve

Click the button below to download a PDF version of this article.

outperformed.

outperformed.